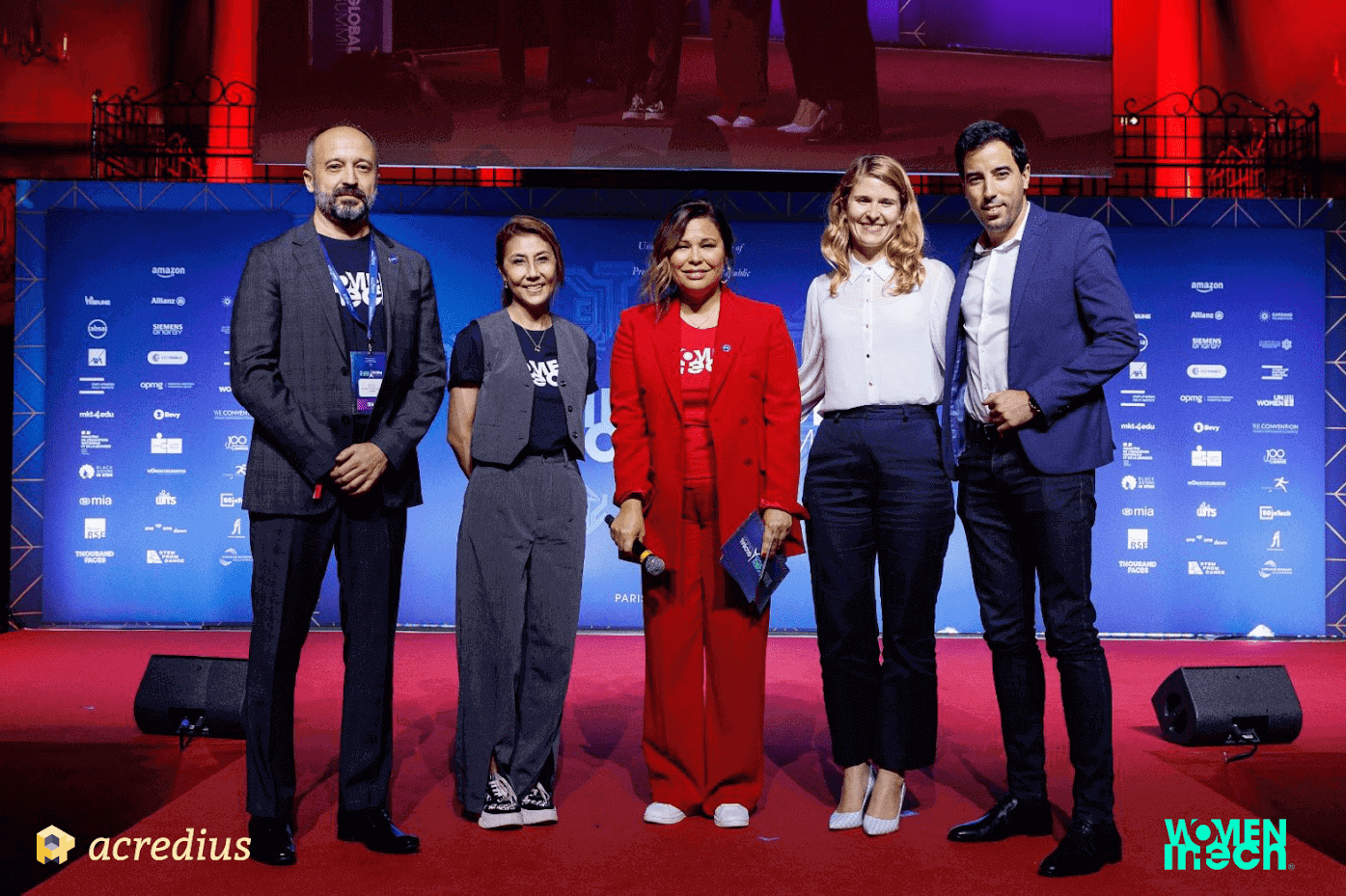

MYBOX is a services company specialized in renting self-storage spaces. It is operating for more than a decade with constant growth and currently offers around 700 storage spaces spread over seven locations in Switzerland. At Acredius, we had the chance to help this aspiring business achieve its growth acceleration goal. In this interview, Mr. Gasser, CEO and Founder of MYBOX, is telling us more about his journey and how Acredius helped him to receive a loan needed to open new facilities and invest in the brand.

Mr. Gasser, first of all, thank you very much for taking the time today to answer a few questions about your experience as a borrower in the Acredius platform. I would like you to tell us more about your business. How does MYBOX serve its clients?

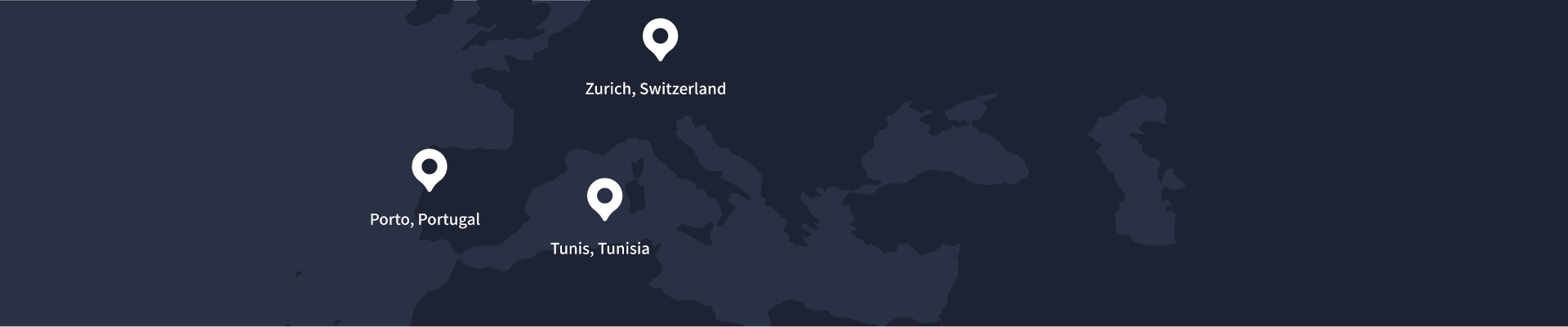

Mr. Gasser: While I was studying economics at the University of Zurich, I started in 2004 with a company specialized in moving services. There I saw the need for self-storage, an industry in which I got involved as soon as 2005–2006. It’s been giving me a lot of satisfaction to come into this business since it is very sustainable and has a lot of opportunities. The market is growing in Switzerland. MYBOX has currently 8 big self-storage facilities, that’s around 700 rooms (boxes). We plan to develop further facilities in the future.

How did a need for further growth through financing come to your mind?

Mr. Gasser: We’ve been growing at a constant pace over the last decade. Nevertheless, we still think there is more potential. We also see the market growing at a faster pace and this led us to be willing to accelerate our progress. To do so, we can extend our existing facilities and we can also add new ones. Our last acquired facility was in Uster and it’s where we are currently focusing. We have already a lot of ideas for the future. We also want to invest in the brand through marketing projects.

My experience with Acredius was definitely positive. We received a loan and we can now invest in our brand and in new facilities. Acredius was clearly a great help for us.

How did you first come across Acredius? Was the crowdlending concept clear to you?

Mr. Gasser: I first heard about crowdfunding and while I was learning about it, I came across an online article comparing all crowdfunding platforms. There was also a section mentioning crowdlending. When I went through it, I thought this could be a great fit for my business. My experience with banks taught me that they don’t really understand what self-storage is about. I think that our business is not very “bankable”, so I thought that Acredius and crowdlending are an attractive option.

We had a few phone calls, which I appreciated a lot. It was very important to me that you were always available to answer my questions.

When you got in touch with Acredius, how would you describe the onboarding process?

Mr. Gasser: We had a few phone calls, which I appreciated a lot. It was very important to me that you were always available to answer my questions. As part of the onboarding process, there were two questions that I think all entrepreneurs should ask themselves: why do you need the loan and why you are worth the investment? I think they are important reflection points for every entrepreneur. For me, it represented no additional work since I had it very clear in my mind. In general, I can say that the onboarding process was quite easy and straightforward.

How did Acredius help you find financing for your project?

Mr. Gasser: Acredius published my project on the platform and brought me together with an institutional investor. I’m very happy that this happened because now I have this investor and we have already made one loan. We are definitely planning to make some more in the future. It is very important for us to have a long-term relationship with our investors.

How would you describe your overall experience with Acredius?

Mr. Gasser: My experience with Acredius was definitely positive. We achieved our goal. We received a loan and we can now invest in our brand and in new facilities. That’s what we wanted. We’re really making a good business and we have a proven track record. We’re doing self-storage for more than a decade. Acredius was clearly a great help for us.

I would recommend Acredius to any business looking for a financing partner.

Would you recommend Acredius to other companies for financing their projects?

Mr. Gasser: Yes, definitely. I would recommend Acredius to any business looking for a financing partner.

Keep reading

Curious to know more? Check out the rest

of our blogs

Watch our YouTube Channel

This channel will cover the Crowdlending industry!

Our mission is to provide you with all the insights

from this market and help you make informed decisions.

Speak to our awesome team

Please feel free to leave us a message here or call us directly. Our expert support team is here to help you!